Buy to Let Mortgage Advisors

Whether you’re aspiring to construct a real estate portfolio reminiscent of Monopoly, leasing your former residence, or simply seeking to invest in your future, Peak Mortgages and Protection is the primary contact you should consider for buy-to-let mortgage solutions.

If you’re a Buy to Let landlord, we understand that trying to find the right buy to let mortgage can be a very challenging prospect with some specialist buy to let deals only available through a broker. Whether it’s the first property you’re buying or if you’re looking to redevelop a current property, refinance to capital raise or expand your portfolio we’re here to help navigate the sea of jargon. You’ll be taking complex terminology like interest-cover-ratios, rental coverage calculations and SPV’s in your stride. Come grab a beer with us and let’s get the ball rolling!

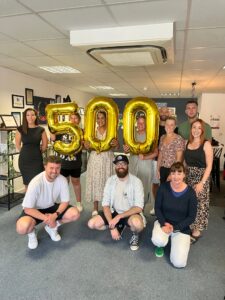

Don’t forget that Peak Mortgages and Protection have over 500 Star reviews from our customers as well as picking up 4 awards.

So if you live in Belper, Duffield, Little Eaton, Ashbourne, West Hallam, Ilkeston, Heanor, Ripley, Langley Mill, Loscoe, Codnor, Riddings, Leabrooks, Somercotes, Alfreton, Pinxton, South Normanton, Tibshelf, Crich, Matlock, Matlock Bath, Cromford, Wirksworth, Hulland Ward, Ashbourne, Swadlincote, Burton, Lichfield, Buxton, Chapel-en-le-Frith, Chesterfield and Derby you know that you really do want us in your corner helping to grow or maintain your property portfolio.

Contact us via phone, messenger, or email, and we will arrange an initial consultation either in person at our Belper Office or through a video call anywhere in the UK. We are available to assist you whenever you require our services, ensuring a hassle-free experience, especially if you are considering a buy-to-let mortgage.

Not all Buy to Let Mortgages are regulated by The Financial Conduct Authority.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

we can help you with both

Are you looking for a personal or limited company Buy to Let Mortgage?

At Peak Mortgages and Protection, we specialise in assisting you with buy-to-let mortgages! Given the recent tax changes, opting for a limited company structure can often be more tax-efficient. However, we recommend consulting with your accountant for personalised advice based on your specific circumstances.

Buy to Let advice

There are a plethora of areas to consider which all vary dependent on your situation:

- Stamp Duty Payable

- Capital Gains

- Early Redemption Charges

- Mortgages options for limited companies

- Interest rates

That’s why we believe it’s important to seek Buy to Let advice. Don’t Worry! You’ll be in safe hands with us every step of the way. Buy to Let is now specialist lending, and at Peak, we have dedicated Buy to Let Mortgage advisers at hand to help.

Discuss Buy to Let Mortgage Advice

How can Peak Mortgages help with Buy to Let Mortgage Advice?

Are you:

- A first-time landlord?

- Interested in expanding your property portfolio?

- Wanting to refurb your current home to be able to let it out?

- An existing landlord whose Buy to Let mortgage is up for review?

- Looking to remortgage for a better deal?

- Interested in converting your current mortgage into a Buy to Let mortgage to rent out?

- Looking to raise capital from your Buy to Let property?

- Looking for a Buy to Let mortgage but worried your circumstances have changed? – for example, income, employment or marital status, since your last mortgage application

- Concerned that your past financial history may have an impact on your Buy to Let application?

These all-important questions could have an array of outcomes. We will use our initial fee free, no obligation consultation to help you find a deal that’s right for you and your situation.

Get in touch with us today to book your appointment for buy to let mortgage advice.

Book your initial fee-free, no-obligation consultation and let’s get to work on finding you the right mortgage deal.

Steps we follow

Our Process

- Give us a call on where we can discuss some initial details

- Complete a fact find with your adviser to work out what hoops we need to jump through

- Let us go away and research the right options for you

- Have a 2nd appointment when we present the solution that fits your circumstances and make sure you understand everything fully

- Let us help guide the transaction through to completion