First Time Buyers

First Time Buyers Mortgage?

first time buyer advice

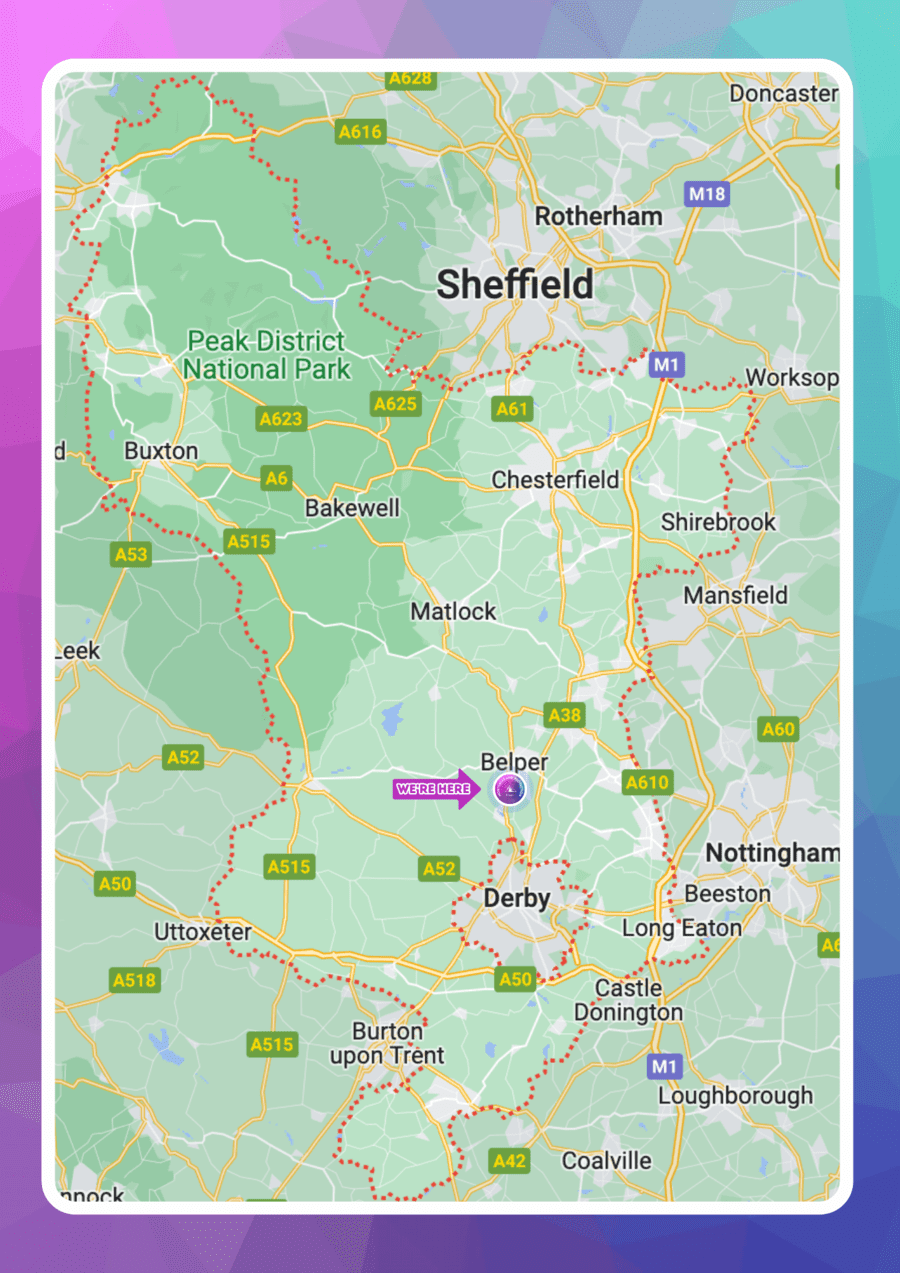

EXPERTS IN YOUR AREa

So if you live in Belper, Duffield, Little Eaton, Ashbourne, West Hallam, Ilkeston, Heanor, Ripley, Langley Mill, Loscoe, Codnor, Riddings, Leabrooks, Somercotes, Alfreton, Pinxton, South Normanton, Tibshelf, Crich, Matlock, Matlock Bath, Cromford, Wirksworth, Hulland Ward, Ashbourne, Swadlincote, Burton, Lichfield, Buxton, Chapel-en-le-Frith, Chesterfield and Derby you know that you can trust us to look after something that’s life-changing.

What’s included in our mortgage services?

Expert Advice

Our team of experienced mortgage advisors specialises in assisting first-time buyers. With authority and a commitment to affordable solutions, we stay up to date with the latest market trends and regulations to provide you with accurate and reliable advice, offering a helping hand every step of the way.

Personalised Approach

We recognise that every individual’s financial situation is unique. Our advisors take the time to understand your specific needs and goals. We’ll provide an idea of how much you might be able to borrow and identify what you’ll need, tailoring our recommendations to find the mortgage solution that best suits you.

Comprehensive Support

From the initial consultation to the final stages of your mortgage application, we provide full support throughout the entire process. We help you take the first step to buy your first home, answering your questions, addressing your concerns, and providing guidance at every appointment.

Why Choose Peak Mortgages for First Time Buyer Advice?

Mortgage Options

We help you explore a range of mortgage options available to first-time buyers. Whether you’re interested in fixed-rate, variable-rate, or government-backed loans like Help to Buy and the First Home Scheme, we’ll explain the pros and cons of each option. Use our mortgage calculator to get an idea of what works best for you, allowing you to make an informed decision.

Affordability Assessment

Determining how much you can afford is crucial. Our team will assess your income, expenses, and credit history to provide an accurate affordability analysis. We’ll help you understand the need for a deposit, how much you could borrow, and the loan to value ratio to find a mortgage that aligns with your financial capabilities.

Pre-Approval Process

Being pre-approved for a mortgage gives you a competitive edge when house hunting. We assist you in preparing the necessary documentation, guiding you through the pre-approval process to determine if you’re eligible. We’ll help you understand how much you might be able to borrow and provide an idea of how much you can afford, increasing your chances of securing your dream home.

First-Time Buyer Incentives

There are various government programs and incentives available exclusively for first-time buyers. We’ll educate you about opportunities like Help to Buy and the First Home Scheme, providing a helping hand to take advantage of these benefits and potentially save you money on deposits, completion costs, or interest rates.

Ongoing Support

Our commitment to you extends beyond securing your mortgage. We’re here to provide long-term support, helping you review your mortgage options as your circumstances change, ensuring you always have the most suitable mortgage solution.

Benefits of a First Time Buyers Mortgage

- Lower Initial Costs: Many first-time buyers’ mortgages require a lower deposit, making it easier to get on the property ladder.

- Exclusive Schemes: Programs like Help to Buy and Shared Ownership are designed to support first-time buyers, offering reduced rates and government contributions.

- Tailored Advice: Specialist mortgage advisors provide guidance tailored to your situation, helping you find the best deal and navigate the complexities of buying your first home.

How to Apply for a First Time Buyers Mortgage

- Assess Your Finances: Before applying, review your financial situation. Check your credit score, savings, and any outstanding debts. Lenders will evaluate these factors to determine how much they can lend you.

- Find the Right Mortgage: Research various mortgage types to find the one that suits you best. Fixed-rate mortgages offer stability, while variable rates may provide lower initial payments.

- Submit Your Application: Once you’ve found a property, complete your mortgage application with the necessary documents, such as proof of income, credit history, and identification.

Key Considerations for First Time Buyers

- Interest Rates: Compare rates from different lenders to find the most affordable option. Remember, even a small difference can significantly impact your monthly payments.

- Loan-to-Value Ratio (LTV): This ratio represents the loan amount compared to the property value. A lower LTV often means better mortgage rates.

- Government Schemes: Explore programs like the First Home Scheme or Help to Buy, which offer financial assistance and lower deposit requirements.

Understanding the First Time Buyers Mortgage Process

The mortgage process involves several steps, from initial consultation to final approval. Here’s what you can expect:

- Initial Consultation: Meet with a mortgage advisor to discuss your financial situation and home-buying goals.

- Pre-Approval: The lender assesses your creditworthiness and provides a provisional loan amount, giving you a better idea of your budget.

- Property Search: With a clear budget, start looking for properties within your price range.

- Formal Application: Once you’ve chosen a property, submit a full mortgage application with all required documents.

- Valuation and Underwriting: The lender will assess the property’s value and verify your information.

- Offer and Completion: After approval, the lender will issue a formal mortgage offer. Once accepted, you can proceed to complete the purchase.

Common Mistakes First Time Buyers Should Avoid

- Overestimating Budget: Be realistic about what you can afford. Consider all expenses, including maintenance, taxes, and insurance.

- Ignoring Additional Costs: Don’t forget about fees such as solicitor costs, valuation fees, and potential repairs.

- Not Getting Pre-Approved: A pre-approval can give you a competitive edge in a hot market and streamline the buying process.

What our Clients Say

The First Free Consultation for First Time Buyer Mortgage Advice

Simply get in touch with us by phone, messenger or email and we’ll book an initial consultation either in person at the Belper Office or over a video call anywhere in the UK. We are here for you when you need us to make the process as stress-free as possible.

That way we can answer any questions you may have, work out what is possible and talk you through the process. We’ll even send you out with a ‘passport to buy’ so that you can send evidence to any estate agents that you’re a serious buyer. We’ll even go that extra mile to help you with things like putting in an offer and give our advice on who the top solicitors to use are for your conveyancing.

If you are a first time home buyer and want to find out why Peak Mortgages and Protection is a 5 star Reviewed brand who have been finalists or won so many awards, get in touch with our first time buyer mortgage advisors today.

And remember – don’t pay more for less.

P.S. We even provide complimentary beers in the office and office puppies to fuss!”

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Frequently Asked Questions

A first-time buyer’s mortgage is a loan designed for individuals purchasing their first property. It often comes with benefits like lower deposits and access to special government schemes.

The amount depends on factors like your income, credit history, and the property’s value. Lenders also consider your debt-to-income ratio to determine the loan amount.

Fixed-rate mortgages offer a set interest rate for a specified period, while variable-rate mortgages can fluctuate based on market conditions.

Yes, some lenders offer mortgages for buyers with lower credit scores, though you may face higher interest rates or require a larger deposit.

An AIP is an initial assessment by a lender to determine how much they are willing to lend based on your financial situation, helping you understand your budget.

Yes, schemes like Help to Buy and the First Home Scheme provide financial assistance and lower deposit requirements for eligible buyers.

Besides the deposit, you’ll need to budget for solicitor fees, valuations, and possibly repairs or renovations.

It can take anywhere from a few weeks to a couple of months, depending on the lender and the complexity of your situation.

It’s crucial to inform your lender if your circumstances change. They may reassess your loan terms, and failing to communicate could lead to difficulties in managing repayments.

A mortgage advisor can offer tailored advice, help you find the best rates, and guide you through the complex process, saving you time and potentially money.

Conclusion

Securing a first-time buyer’s mortgage is a significant step towards homeownership. By understanding the process and seeking professional advice, you can make informed decisions that align with your financial goals. Explore your options, take advantage of available schemes, and enjoy the exciting journey of buying your first home. If you have more questions or need personalised advice, contact our expert mortgage advisors today.