Should you use a mortgage adviser?

Getting a mortgage is probably one of the biggest financial decisions you’ll make, so it’s important to get it right. A mortgage adviser can search the market on your behalf and recommend the best deal for your circumstances. That’s what they are there to do.

They don’t work for a bank, but they search across multiple lenders to find the right option for you. That may even be who you bank with but at least you’ll know!

Why it’s usually a requirement that you get mortgage advice

Mortgage advisers have a wide knowledge of the mortgages available from different lenders. They can search the market on your behalf and recommend the right deal and lender.

If you did this on your own it would involve a lot of research and talking through your circumstances many times with different lenders. Plus when rates are changing on a regular basis, by the time you have spoken to one lender, someone else may actually be offering the right deal. In our book, that’s not a good use of your time when we are here ready to make your life quicker and easier!

An adviser might also be able to find a deal you can’t find on your own. They can also improve your chances of being accepted for a mortgage as they’ll know which lenders are best suited to your particular circumstances.

This is particularly important if you don’t have a large deposit, haven’t been with your employer for long (in fact some lenders don’t even need you to have received the first payslip) or if you’re self-employed.

Risks of not getting advice

When you get regulated mortgage advice rather than doing research on your own, your mortgage adviser will recommend the right product for your needs and circumstances.

If the mortgage later turns out to be unsuitable for any reason, you can make a complaint. If necessary, you can take your complaint to the Financial Ombudsman Service. This means you automatically have more rights when you take advice. If we get it wrong, you have someone to sue which is why we make extra sure that our advice is bang on!

Not getting advice means you have to take full responsibility for your mortgage decision.

If you don’t get advice, you could end up with the wrong mortgage for your situation, which would be a costly mistake in the long run.

applying for a mortgage that doesn’t fit the lender’s lending criteria which may mean huge delays, losing property or spending time stuck on a lender’s standard variable rate.

Not being able to use your adviser’s expertise when it comes to not just getting your mortgage offer issued, but also chasing estate agents and solicitors to push your transaction along. It’s not glamorous, but advisers save so many transactions from falling apart which could cost you a lot of money in wasted fees

When to see a mortgage adviser

Our advice is to do this as early as possible whether it’s your first mortgage or you’re looking to re-mortgage. It will save you a lot of time and effort, in the long run, to be the person to sell a property.

Sometimes it may also be that an adviser tells you that what you want to do isn’t possible right now but comes up with a plan of action to get you ready to get the house that you want!

There are two main types of mortgage advisers:

- Mortgage advisers connected directly to lenders usually only recommend mortgages from that specific lender.

- Mortgage brokers can look at a range of mortgages from different lenders.

You may hear the term ‘whole of market’ banded about which isn’t particularly helpful in our opinion. Even whole of market advisers doesn’t cover everything as no broker has access to every product with every lender. Some lenders will have exclusive deals only available if you go to them directly, some lenders only deal with brokers, some lenders will have exclusive deals with particular firms and some lenders don’t work with particular brokers. It’s a minefield.

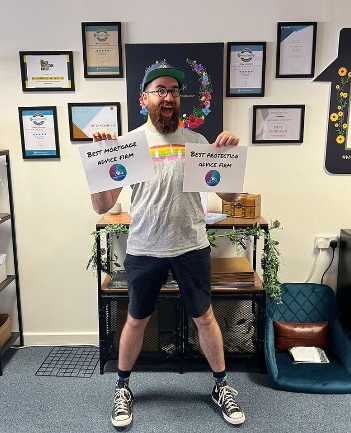

Our suggestion is to do your research. Go on Google and check out a firm’s reviews. It’s the best place to work out who you want to look after you on this transaction but for the decades to come when you may have a mortgage.

Oh, and definitely pick a firm with free beer and puppies to play with!

Firms offering mortgage advice must be regulated and authorised by the Financial Conduct Authority (FCA). Details of all regulated firms are held on the FCA’s Register.

Other reasons to use a mortgage adviser

- They’ll check your finances to make sure you are actually likely to meet the individual lender’s lending and affordability criteria before wasting hours of your time on applications that will just never fit.

- They might have exclusive deals with lenders, not otherwise available.

- They often help you complete the paperwork, so your application should be dealt with faster.

- They’ll help you take all the costs and features of the mortgage into account, beyond the interest rate. Our standard is to recommend not just the cheapest rate, but what will cost a client the least amount of money overall. The most pounds left in your back pocket is key.

Finding a mortgage adviser

Our advice is simple – get on Google, search for mortgage advisers near you and pick based on reviews. Most of our clients are based in Derbyshire because they’ve found us this way but we do advise clients nationally

Also, ask your friends and family who they’ve had a great experience with.

All mortgage brokers receive a commission from the lender and have to disclose this but some advisers might charge you for their service on top of this, depending on the product you choose or the value of the mortgage. This charge could be a flat rate or hourly rate, or a percentage of the amount you borrow.

At Peak Mortgages & Protection, we aren’t overly keen on the idea of charging a fee on a straightforward residential case. That’s why we always try to make our residential mortgage advice fee-free. Get in contact with us today!